Once again, our provincial government is considering privatization as a way to solve their current financial woes.

Once again, they’re promising to use evidence-based decision making.

That’s a good thing. Because the evidence is clear – has been clear for a very long time – privatization is not the solution.

Tell your MHA No!

You can send an email

Why is our provincial government talking about privatization right now?

It’s no secret that Newfoundland & Labrador is facing fiscal challenges. Shortly after his election, Premier Furey announced he intended to get advice from the brightest and the best. His approach was to put together a Premier’s Economic Recovery Team (PERT). A government news release provided the following mandate for PERT:

The Premier’s Economic Recovery Team is tasked with developing a plan of action that will respond to the Province’s immediate fiscal challenges and plot a new course forward. In addition, the Economic Recovery Plan should also focus on programming to revitalize the economy and identify the changes required to get us there.

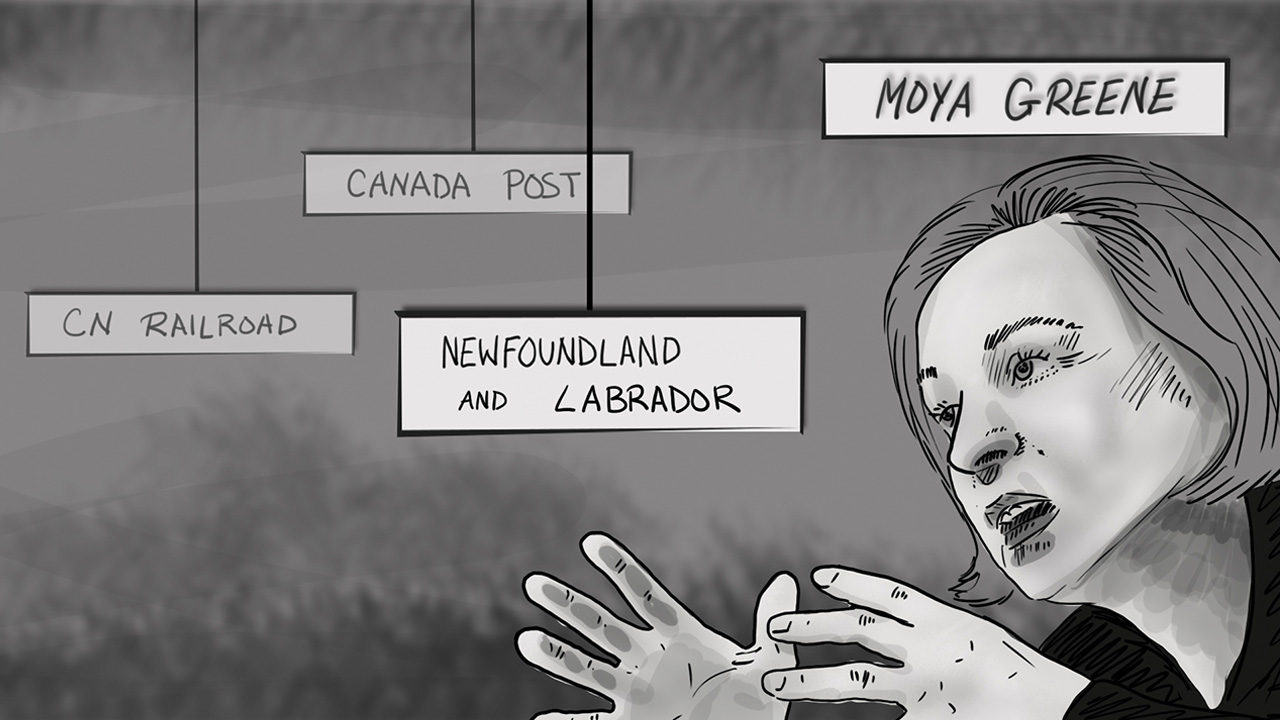

Furey appointed UK-based Dame Moya Greene to head PERT. Greene is well known for her work in privatizing CN railway, the deregulation of the Canadian airline industry, and a contentious stint as CEO of Canada Post. She moved from Canada to the UK where she was the driving force in privatizing Britain’s Royal Mail.

In May of 2021, PERT issued its report, ‘The Big Reset.’ Among other things, it said “The NLC is a profitable entity and has consistently paid the province a considerable dividend. In the last 10 years, dividends have totalled $1.6 billion.”

And yet – in direct opposition to the evidence – one of the report’s recommendations was, “The Provincial Government should sell all or a majority interest in the Newfoundland Labrador Liquor Corporation.”

In that same report, Moya Greene also recommended privatizing Motor Vehicle Registration and the Registry of Deeds, Companies and Securities, which between them netted the provincial government $161 million in fiscal year 2019-20 alone. This income is also needed to provide public services like health care and education.

On November 23, 2021, the NLC announced that it “is currently on pace to deliver a dividend of $210.0 million in fiscal year 2022, which would be the largest in the organization’s history.”

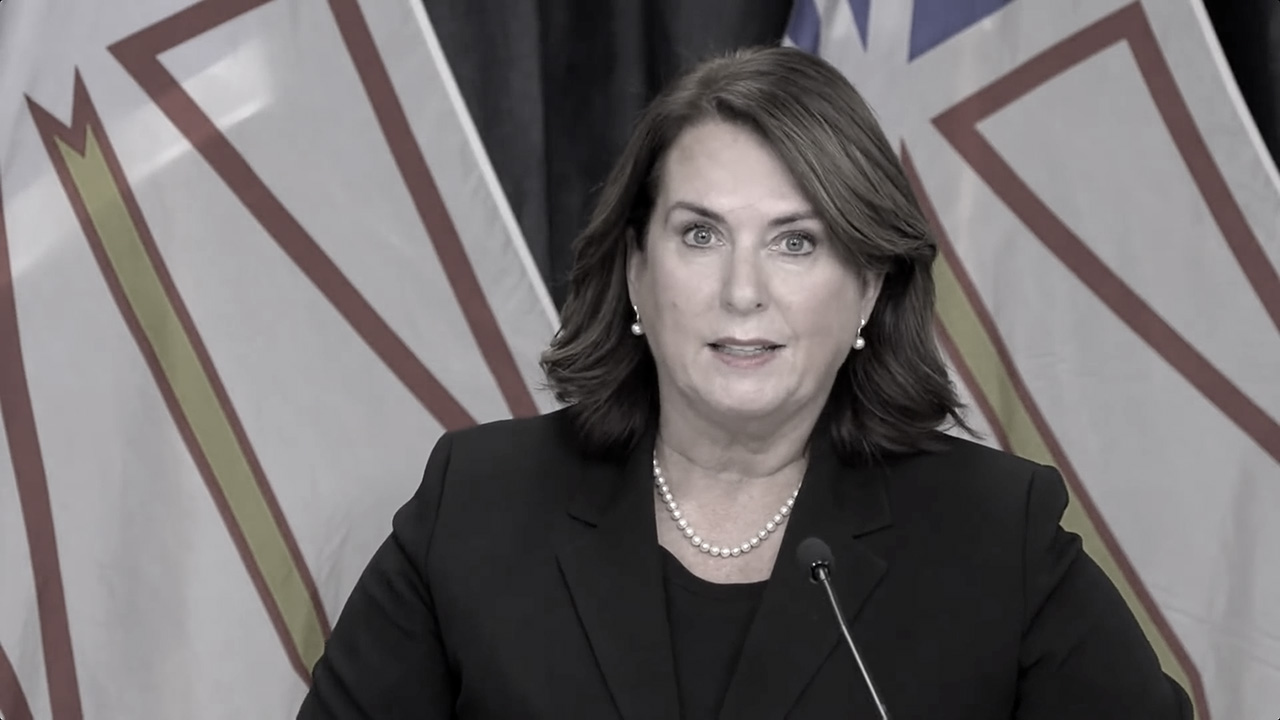

The very next day, the Government of Newfoundland and Labrador issued a Fall Fiscal and Economic Update. During that update, Finance Minister Siobhan Coady said:

I will say NLC has indicated … a record amount of dividend coming to the people of the province this year, which is very positive for us. That means investments in health care and education, for example … We’ve gone through a request for proposals to bring in an outside expert who’ll look at the cost, the benefits of monetization [by which she means privatization]. Who’ll take into consideration the amount of money … we do realize from … the Newfoundland Liquor Corporation every year. And that will be part of the decision-making process. And how it is best for the people of the province. So all that will be weighed and factored in when we consider whether or not we monetize [privatize] that asset [the NLC].

On December 15, 2021, Minister Coady announced the Government of Newfoundland and Labrador had retained Rothschild & Co. to review a number of public assets – including the NLC. London-based Rothschild & Co. stands to make upwards of $5 million for its efforts. For decades, Rothschild has been an advisor to governments worldwide on privatization.

To add insult to injury, Coady, “wouldn’t confirm the report would be made public, due to the potential presence of ‘commercially sensitive information.‘”

And while they’re at it, the provincial government has also asked Rothschild to review Motor Vehicle Registration and the Registry of Deeds, Companies and Securities. There are also rumblings that Rothschild is reviewing other government services too, like ferries, the air ambulance service, and highway snow clearing.

Government and its consultants will try to convince you that the benefits of government’s getting a big lump of cash to pay down on its debt outweigh the benefits of receiving hundreds of millions of dollars every year. In fact, the sell-off of major public assets and infrastructure to private, for-profit corporations or equity partners will mean the loss of billions of dollars of revenue for the people of Newfoundland & Labrador.

They will try to convince you that privatization means cheaper, better-quality services. None of these things is true.

What Moya Greene didn’t say, what our government isn’t saying, and what Rothschild won’t say is that the evidence shows privatizing public services for short-term monetary gain is a BIG MISTAKE.

SOURCES:

Government of Newfoundland & Labrador, Executive Council. (2020, October 22). Premier Furey announces members of Economic Recovery Team [News release]. https://www.gov.nl.ca/releases/2020/exec/1022n02/

Premier’s Economic Recovery Team. (2021 May). Big Reset. Report of the Premier’s Economic Recovery Team. https://thebigresetnl.ca/wp-content/uploads/2021/05/PERT-FullReport.pdf

Department of Finance. (2020). Estimates of the Program Expenditure and Revenue of the Consolidated Revenue Fund 2020-21. Government of Newfoundland and Labrador. https://www.gov.nl.ca/budget/2020/wp-content/uploads/sites/3/2020/09/Estimates-2020.pdf

Newfoundland & Labrador Liquor Corporation. (2021, November 23). Newfoundland & Labrador Liquor Corporation (NLC) announces second quarter (Q2) performance [News release]. https://nlliquorcorp.com/about-newfoundland-labrador-liquor-corporation/news-releases/263-newfoundland-and-labrador-liquor-corporation-nlc-announces-second-quarter-q2-performance

Government of Newfoundland & Labrador. GovNL. (2021, November 24). Fall fiscal and economic update [Video]. https://www.youtube.com/watch?v=QySGl-2qMlw

Kennedy, A. (2021, December 15). All N.L. assets up for review, say finance minister, but opposition says ‘enough is enough.’ CBC. https://www.cbc.ca/news/canada/newfoundland-labrador/nl-rothschild-assets-review-1.6285354

What is privatization?

Privatization comes in many forms. Here are the basics.

Selling

The simplest form of privatization is when a government sells the right to deliver a public service to a company or a consortium of companies.

Contracting Out / Outsourcing

Another common form of privatization is contracting out or outsourcing. That’s when government awards a contract – usually a long-term contract – to a company or consortium of companies to deliver a public service for a set amount of time.

Public-Private Partnerships (P3s)

Public-private partnerships (P3s) are another form of privatization. Take for example a P3 in which a government hires a company or consortium of companies to build a hospital. The private sector raises the money, builds the hospital, maintains the hospital on a contractual basis, and somewhere down the road may sell the hospital back to the government.

Governments are constantly looking for other words to use instead of privatization. In the case of the Furey government, when they say asset monetization, it’s usually code for privatization.

Why do governments want to privatize?

One-time payout to pay down debt. Governments claim that privatizing public services like liquor stores and government registries will give them a lump sum of money they need to pay down debt. What they don’t tell you is that those public services bring in millions of dollars a year in revenue that’s needed to pay for things like health care and education.

Once a public service is privatized, that income is gone forever. And no, sales tax and corporate income tax will never come close to replacing that revenue. That money is gone for good – usually to big national or multi-national companies.

Speaking of corporate income tax, many of the corporations involved in buying public assets and contracting out of public services register in tax havens and pay no taxes!

How much is at stake for our province? Between the NLC and the provincial registries, it’s upwards of $400 million dollars – each and every year.

Lower costs a myth

Governments claim privatization leads to lower costs for users.

When a government contracts out a public service, it usually awards the contract to the lowest bidder. A corporation’s main goal is to make money for its shareholders. In order to have the lowest bid, it looks for ways to save money. It pays people as little as possible. It cuts staffing to the bare minimum. It replaces people with technology. (Just think about self-serve. Did prices go down when people had to check themselves out? Of course not!) It sends jobs offshore to countries where wages are low. It scrimps on materials (in Ontario, the private corporation awarded the contract for highway snow clearing scrimped on salt and sand). It buys lower-quality materials (think about the quality of the asphalt used on our streets and highways). It cuts the level of service. (Not only did that Ontario company scrimp on salt and sand, it cleared the highways less often!) And where it can, it raises fees. That’s exactly what happened in Ontario, Manitoba, and Saskatchewan when they privatized their land registries. Not only did fees go up, their fees are now the highest in Canada!

Despite the promise of cheaper booze, most users in Alberta didn’t get to enjoy lower prices for liquor after their liquor stores were privatized – unless they lived in Calgary or Edmonton – where prices on the most common products dropped a little. They also didn’t get the bigger selection of products they were promised (except in the biggest stores in the biggest communities). And unlike public liquor stores, private liquor store owners are under no obligation to sell the same product for the same price in every community in Alberta – a big, red flag for people living in rural communities. In Saskatchewan, privatization led to similar results – loss of stores, jobs, and selection.

Better quality a myth

Governments looking to privatize will often argue that the private sector is more efficient and will deliver a better quality of service. Just ask the people of Ontario how that worked out for them. When the provincial government privatized highway snow clearing, frequency of snow clearing declined, the amount of salt and sand used declined, and accidents went up! When they privatized cleaning in BC hospitals, infection rates went up! And the all-too -chilling news stories about the high volume of deaths in private long-term care facilities during the early days of COVID should also serve as a warning.

Government’s real reasons

The truth is that there are a number of self-serving reasons governments like privatization.

Lack of accountability. Governments find the concept of privatizing public services appealing because it means they can wash their hands of responsibility. Because unlike governments, which answer to taxpayers, corporations answer only to their shareholders.

To look more fiscally responsible. Governments like privatization because it gets the cost of delivering public services off their books. It makes it look like they are improving provincial finances. And yet, taxpayers are still footing the bill.

To keep party donors happy. If you take the time to review the records of which corporations donate to political campaigns, you’ll often find the true beneficiaries of privatization listed among the donors. You’ll also find privatization consultants on that list of donors. They’re the companies who are brought in after a government has decided to privatize public services in order to justify that decision – and they’re usually paid a lot to do so.

Preparing to privatize

In addition to bringing in consultants to tell them what they want to hear, governments looking to privatize public services will try to make existing services look as bad as possible. Cutting staff is popular. You’ll see governments cutting nurses in long-term care and cutting cleaning positions in hospitals to make people unhappy with the level of service and more likely to support privatization.

What makes it so hard to return a privatized service to the public sector?

And if a government is successful in privatizing a public service, it will go out of its way to make it more difficult and expensive to bring that service back to the public sector. For example, when a government privatizes highway snow clearing, it will sell all its heavy equipment – often for pennies on the dollar – and often to the private sector company that won the contract. It’s a fact that one of the major problems associated with privatization of public infrastructure is that public assets are routinely undervalued when sold.

Case study: Britain’s Royal Mail

Moya Greene was the CEO of Great Britain’s Royal Mail from 2013 to 2018. Her success or lack thereof in privatizing the Royal Mail gives a clear example of the many problems associated with privatization and the selloff of public infrastructure to for-profit investors.

Over the course of Moya Greene’s employment with the Royal Mail, 12,000 jobs were cut, and yet the newly privatized Royal Mail paid out almost $1 billion to rich shareholders. And while hundreds of mail centres and delivery offices were being closed, Dame Greene received an astronomical $3.2 million in salary in 2017 alone – salary paid for by the public.

Today, the Royal Mail is losing 1 million British pounds – roughly $1.7 million Canadian – EVERY DAY. Yet its executive and shareholders are still receiving dividends.

SOURCES:

SGEU. 2016. Reports show liquor store privatization a serious loss for small towns. News release. Via https://www.sgeu.org/news/sgeu-news/reports-show-liquor-privatization-a-serious-loss-for-small-towns.

Campo, Matthew. 2016. A sober reminder: Economic impacts of liquor store privatization in small town Saskatchewan. Regina, SK. Canadian Centre for Policy Alternatives. Via https://www.policyalternatives.ca/publications/reports/sober-reminder#:~:text=A%20Sober%20Reminder%3A%20Economic%20Impacts,four%20communities%20that%20experienced%20privatization.

Kollewe, Julia. (2016, June 3). “Royal Mail’s Moya Greene reaps another £1.5m pay package.” The Guardian. Via https://www.theguardian.com/business/2016/jun/03/royal-mails-moya-greene-reaps-another-15m-pay-package.

Furniss, Gill. (2018, October 15). “Five years since the privatization of the Royal Mail, the consequences are being felt more than ever.” Huffington Post UK. Via https://www.huffingtonpost.co.uk/entry/five-years-on-the-consequences-of-privatisation-of_uk_5bc495ece4b0484342b6b7b4.

Makortoff, Kaylena. (2020, June 25). “Royal Mail to cut 2,000 management roles.” The Guardian. Via https://www.theguardian.com/business/2020/jun/25/royal-mail-to-cut-2000-management-roles.

Salmon, James. (2020, June 25). “Royal Mail axes 2,000 jobs as it loses 1m a day. Union outrage as boss says cost cuts and overhauls are needed to ensure firm’s survival.” This is Money. Via https://www.thisismoney.co.uk/money/markets/article-8461167/Royal-Mail-axes-2-000-jobs-loses-1m-day.html.

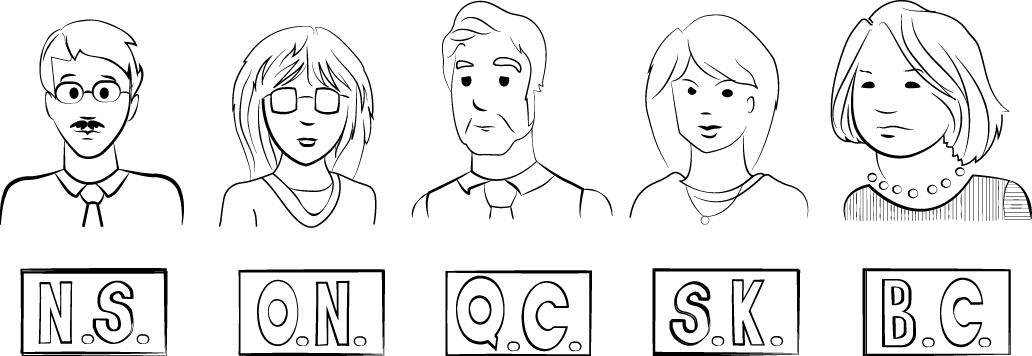

Five Provincial Auditors General Say Privatization Costs More.

Privatization is often promoted by governments as a way to save money. These 5 provincial Auditors General say that’s often not the case, citing amongst other things the higher rates the private sector pays to borrow money (almost double what governments pay).

A way to transfer risk. Governments in favour of privatization will often try to justify it by saying privatization transfers all the risk to the private sector. These auditors general also found out that instead of transferring the risk to the private sector – provincial governments usually end up assuming all the risk.

An opportunity for corruption and fraud. The $22.5 million corruption scandal arising from the $1.4 billion contract to build McGill University Hospital is one of many examples.

Ontario

In her 2014 report, Ontario’s Auditor General, Bonnie Lysyk, reviewed 74 Public-Private Partnership (P3) projects and concluded they cost the province $8 billion more than if they had been procured publicly. She also questioned the main justification for using P3s – the assertion that doing so transferred risk to the private sector.

She felt the P3 projects used unrealistically high risk transfer, averaging about 50% of the capital costs, concluding that “there is no empirical data supporting the key assumptions used by Infrastructure Ontario to assign costs to specific risks.”

According to Lysyk, the government’s “value assessments” are little more than junk science. “The probabilities and cost impacts are not based on any empirical data that supports the valuation of risk,” she said in her report.

In 2008, then Ontario Auditor General Jim McCarter determined that the William Osler Centre, a P3 hospital in Brampton, could have been built for $200 million less through traditional public financing. He also found that the cost of the public option was overstated by more than $600 million.

British Columbia

In 2014 Carol Bellringer, Auditor General of British Columbia, raised major concerns about the high cost of debt acquired through P3 projects. She examined 16 different P3 projects in the province and reported:

“The interest rates on this $2.3 billion of P3 debt range considerably, from 4.42% to 14.79%, and have a weighted average interest rate of 7.5%. Over the last two years, government had a weighted average interest rate on its taxpayer-supported debt of about 4.0%…”

Her review shows that P3 projects are creating higher levels of debt than if the government had financed the projects itself, since interest rates for P3s are almost double what governments pay.

Partnership BC

Partnership BC is the body the current Government of Newfoundland and Labrador has retained as a consultant to help with the privatization of long-term care. In 2015, the BC Finance Ministry produced a review of Partnership BC that was highly critical of some of its activities, flagging “issues of conflict of interest, dubious practices, and questionable assumptions in the multi-billion-dollar program.”

Quebec

In 2010 Quebec’s Auditor General, Renaud Lachance, found that the Montreal University Health Care Centre P3 cost more than the public option, and that the analysis used to compare the P3 model to a conventional public model was flawed. Instead of the P3 model saving $33 million, the provincial auditor found that the public model would have saved $10 million. The auditor’s special report to the National Assembly also found that there was a cost overrun of over $108 million to the original price tag of $5.2 billion.

A number of the key people involved in the McGill University hospital P3, including ex-CEO of McGill University hospital, Arthur Porter, and Pierre Duhaime, former CEO of SNC Lavalin, were charged in connection with a $22.5 million corruption scheme related to the $1.4-billion contract to build the hospital.

Recently two researchers from Montreal calculated that the Government of Quebec would save up to $4 billion if it bought back the two super hospitals from the P3 consortium.

Nova Scotia

In 2010 Auditor General of Nova Scotia Jacques Lapointe reported on his review of 39 P3 schools in that province. He cited numerous and significant problems with the administration of the contracts. Lapointe concluded that “[t]he terms of service contracts are not adequate to ensure public interest is protected …The lack of these significant contract terms impairs the Department’s ability to hold the developers accountable and effectively manage the contracts.”

He also noted that risk was transferred back to government, and developers were being paid twice for the service, resulting in deficits for local school boards.

Saskatchewan

In 2010, the Saskatchewan Ministry of Health signed a Memorandum of Understanding with Amicus Health Care Inc. to build a 100-bed long term care facility in Saskatoon. Amicus financed 100% of the capital costs and receives monthly capital and operating lease payments from the province over seven years.

The Provincial Auditor of Saskatchewan, Bonnie Lysyk, criticized the absence of a cost benefit analysis: “The proposed daily capital rate is higher than other affiliates [nursing homes] because of Amicus borrowing 100% of the capital required for construction. We were unable to obtain the basis for calculating this rate for Amicus. As well, neither the [Ministry of] Health nor Saskatoon [Health Region] could provide us any written analysis to support that funding long-term beds in this new way is cost effective for the Province.”

The Auditor also noted that once the construction was completed, the Saskatoon Health Region “assumes the risk over debt repayment and the operation of the new facility.”

Economist John Loxley also reviewed what little information was disclosed about the Amicus deal. He concluded that private financing would cost $11 to $20 million more than if the province had built the facility.

SOURCES:

Auditor General of Ontario. 2014 Annual Report. http://www.auditor.on.ca/en/reports_en/en14/2014AR_en_web.pdf

Auditor General of Ontario. 2008 Annual Report.

http://www.auditor.on.ca/en/reports_en/en08/ar_en08.pdf

Government of British Columbia. Office of the Auditor General. 2014 Summary Financial Statements and the Auditor General’s Findings. November 2014. http://www.bcauditor.com/sites/default/files/publications/2014/special/report/AGBC%20ROPA-FINAL.pdf

Government of British Columbia. Ministry of Finance, Internal Audit and Advisory Services. http://www.fin.gov.bc.ca/ocg/ias/pdf_docs/Review%20of%20PBC.pdf

Auditor General of Quebec. Report of the Auditor General of Québec to the National Assembly for 2010-2011: Special report dealing with the watch over the projects to modernize Montréal’s University Health Centers (Highlights) http://www.vgq.gouv.qc.ca/en/en_publications/en_rapport-annuel/en_fichiers/en_Rapport2010-2011-CHU.pdf

Seglin, Dave and Nicol, John. Who’s who? McGill University hospital $22.5M bribery case. CBC News. Updated Sept. 10, 2014. http://www.cbc.ca/news/who-s-who-mcgill-university-hospital-22-5m-bribery-case-1.2743193

Nguyen, Mihn and Hebert, Guillaume. Should we buy back the PPP for the CHUM and the MUHC. Socioeconomic Research and Information Institute (IRIS). October 2014. http://iris-recherche.s3.amazonaws.com/uploads/publication/file_secondary/CHU-PPP-English-WEB.pdf

Auditor General of Nova Scotia. 2010 Annual Report.

http://oag.novascotia.ca/sites/default/files/publications/2010%20-%20Nov%20-%20Full%20-%20NSOAG%20Report.pdf

Provincial Auditor of Saskatchewan. Report of the Provincial Auditor 2011. Vol. 2. https://auditor.sk.ca/pub/publications/public_reports/2011/2011-report-volume-2/2011vol2fr.pdf

Loxley, John. The Trouble with the Amicus Deal: Six Reasons the Amicus Deal will Cost the Province More. CUPE. 2012. http://sk.cupe.ca/files/2013/04/Amicus-Deal-Report-19-March-2012.pdf

More About the Cost of Privatization

McKenna, Barrie. “Canadian governments have become seduced by private-public projects.” Globe and Mail. December 14, 2014. http://www.theglobeandmail.com/report-on-business/canadian-governments-have-become-seduced-by-private-public-projects/article22078500/

National Union of General and Public Employees. A collection of items about privatization in Canada. http://nupge.ca/issues/privatization?page=15

Think it couldn’t happen in Newfoundland & Labrador?

Increasingly, the Government of Newfoundland & Labrador is relying on P3s to build public infrastructure. So how is that working out?

On April 12, 2019, the provincial government announced it had awarded the contract to build two 60-bed long-term facilities – one in Gander and one in Grand Falls-Windsor – to a consortium. These new, badly needed facilities were supposed to open in 2021. That opening has been delayed until some unspecified date in 2022. Information obtained through the access-to-information process revealed that inspectors had found thousands of deficiencies – more than 400-pages worth – including problems with ventilation and accessibility.

SOURCES:

Whiffen, G. (2021, December 1). Thousands of deficiencies keep long-term care homes in central Newfoundland from opening. The Telegram. https://www.saltwire.com/newfoundland-labrador/news/thousands-of-deficiencies-keep-long-term-care-homes-in-central-newfoundland-from-opening-100665230/.

(2021, December 2). Construction issues will delay opening of 2 N.L. long-term care homes. CBC. https://www.cbc.ca/news/canada/newfoundland-labrador/construction-delays-long-term-care-gander-grand-falls-windsor-1.6270107.

Privatization Myths

MYTH 1: Privatized services are cheaper

BUSTED! You’ll often hear that the price of liquor is lower in Alberta, where the sale of alcohol was privatized years ago. While popular items may be cheaper in big stores in big communities like Calgary and Edmonton, that’s not true in smaller stores or in smaller communities. Because in Alberta, liquor stores don’t have to charge the same amount for the same product. That’s a big red flag for people living in rural parts of our province.

But you don’t have to leave our province to see that private isn’t necessarily cheaper. The private sector already operates 7 of the 12 ferry services. Last year, 6 of those 7 privately operated ferry services received subsidies from the provincial government of 90% or more, while the 7th received an 85.7% subsidy.

Our public air ambulance service is underfunded, creating an opportunity for the private sector to pick up the slack. The catch? It costs government (taxpayers) almost twice as much to have a patient transported by a privately operated air ambulance.

Private isn’t cheaper because corporations exist to make money for their shareholders. Unless they can charge more or cut services, they will demand government subsidies.

MYTH 2: Privatized services are better

BUSTED! When your bottom line is making a profit, quality is going to suffer. You’re going to cut staff. You’re going to hire cheaper, less-qualified staff. You’re going to pressure employees to cut corners. And if at all possible, you’re going to send the work to countries where wages are really low.

When hospitals in BC privatized cleaning services, infections rates increased. Private sector operators didn’t train staff. Low wages meant staff were constantly quitting. And the demand to clean quicker meant things weren’t being cleaned thoroughly. Last year, BC had to contract in hospital cleaning services. That means they had to return the work to the public sector.

When your bottom line is making a profit, you’re going to use the cheapest materials you can find (just think about the quality of asphalt that’s used on our highways and streets). You’re going to cut the amount of material that’s used. (In Ontario, private-sector operators used less salt, sand, and de-icing liquid when they cleared the highways – and the number of accidents increased.)

When your bottom line is making a profit, you’re going to cut services. Private-sector operators in Ontario took longer to clear the highways. BC’s privatized ferry system has cut services to northern communities.

When governments privatize a public service, they like to make it as hard as possible to return that service to the public sector. They accomplish that by doing things like Ontario did when it privatized highway snow clearing – they sold government equipment, paid for by taxpayers, to the private-sector operators who had won the contracts – for pennies on the dollar!

MYTH #3: Privatization saves money.

BUSTED! Privatization often raises costs for members of the public and for governments. After 40-plus years of governments’ privatizing and contracting out public services, there is a lot of evidence showing that the promised cost-savings rarely happen. That’s because of the hidden costs of privatization that governments often fail to mention. These can include the cost of monitoring work done by contractors, enforcing contract rules, negotiating contract changes when need, and taking legal action when a contractor breaks a contract.

Contracts in privatization deals often require governments to pay penalties for any government action that cuts into a contractor’s profit. For instance, after the City of Chicago privatized its parking meters, the city had to compensate the private contractor for anything that reduced parking use, such as street repairs, block parties, and public parades.

It’s no surprise that governments are returning privatized services back to the public sector – a process known as ‘contracting in.’ The two most common reasons for contracting in are because the government failed to save money and / or the service quality was poor.

For example, the Town of Conception Bay South contracted in the garbage collection service it had previously privatized. Now residents are more satisfied, and the Town expects to save $100,000 annually.

MYTH #4: Private companies do a better job and provide higher quality services than the public sector.

BUSTED! The truth is, there is often a noticeable, measurable decline in public service quality after privatization. That’s because time is money, so workers are pressured to cut corners.

In fact, poor service quality is the #1 reason that governments choose to contract in public services. Just as an example, when public services are privatized, it is often hard to get complaints about poor service addressed. In Saskatchewan, ordering a simple repair at a P3 school requires finding your way through an elaborate system just to figure out who is responsible for repairing what.

MYTH #5: Privatization will create efficiencies by introducing competition.

BUSTED! Governments often say privatization will create efficiencies in delivering public services by introducing competition. In fact, often privatization results in no competition at all.

That’s especially true when a public asset is sold to a single corporation or when contracts to deliver a public service are given to a single private-sector contractor. When either of these things happen, no other businesses are allowed to offer the service – resulting in no competition whatsoever. Monopolies in the private sector mean the public loses because the successful corporation is free to charge higher prices and deliver poor quality services.

That’s possible because while governments are accountable to the public – private corporations are not. That leaves them free to place profits ahead of delivering quality services.

When a private corporation buys a public asset or is awarded a contract to deliver a public service, it is in their best interest to limit competition. A corporation can accomplish that by requiring that government include a non-compete clause in the contract.

Non-compete clauses eliminate competition and limit a government’s ability to make policy decisions, even though they are in the public’s best interests, if they might negatively impact the private corporation’s income.

MYTH #6: It doesn’t matter who delivers our public services.

BUSTED! People who support privatization often argue it doesn’t matter who delivers our public services as long as the services are delivered. But having profit as your #1 objective often works against the people public services are meant to benefit.

The drive for profit creates low-wage, part-time, and temporary workforces with little incentive to deliver quality public services. It increases the potential for risky, unsafe, and even illegal work practices.

Privatization also adds another layer of bureaucracy between the public and elected officials, making it harder to get complaints about public services addressed.

Privatization threatens an important part of our democracy. Because while there are laws that require governments to operate openly and transparently, these laws don’t apply to private corporations – even when they’re being paid to deliver public services.

Private contractors will claim commercial confidentiality, proprietary knowledge, or third-party status to deny public access to their contract information. Yet the information contained in these contracts is often of real concern to the public.

For example, a P3 contract to build and operate a school can forbid that school from allowing community use of the building – a serious threat to the quality of life in small communities. Any citizen would consider this kind of information essential to making an informed decision about a P3 project.

By privatizing a public service, governments can hide information and records from the public. This undermines the public’s right to open and transparent government. By limiting what information citizens can access, privatization also reduces citizens’ ability to make informed policy choices and threatens our democracy.

MYTH #7: Privatization creates more jobs.

BUSTED! Corporations exist to make as much profit as possible for their shareholders. They do that by cutting jobs, cutting wages, by pressuring employees to cut corners, and by shipping jobs out to countries where wages are low.

Private sector employers are also more likely to offer part-time and temporary employment, and they’re less likely to provide benefits like health insurance and paid sick leave.

MYTH #8: Privatization allows governments to better anticipate and control costs.

BUSTED! What the evidence shows is that cost estimates provided to governments by private-sector contractors are extremely unreliable, and privatization often results in unforeseen costs.

MYTH #9: Privatization reduces governments’ administrative burden.

BUSTED! Privatization requires substantial administrative resources to make sure the work is done, and done right. Government must monitor the quality of work done by contractors, enforce contract rules, negotiate contract changes when necessary, and initiate legal action when a contractor breaks a contract.

MYTH #10: The public still controls privatized assets and services, and government is still able to make related public policy decisions.

BUSTED! Privatization can tie the hands of policymakers for years allowing private corporations significant control over public assets and services. It can give private corporations the power to dictate important policy decisions. In particular, non-compete and make-whole clauses in privatization contracts, which are designed to protect the private-sector contractors’ income, can tie governments’ hands when it comes to making public policy decisions.

MYTH #11: If something goes wrong, government can easily fire the contractor or adjust the contract.

BUSTED! It usually involves legal action and almost always leads to service interruptions. Contracts are not easily broken without penalties.

MYTH #12: Companies are chosen for privatization contracts based on merit, not on political or financial connections.

BUSTED! Government for profit opens doors for unscrupulous behaviour by politicians and businesses.

MYTH #13: Proceeds from the sale of public assets will get our province out of debt.

BUSTED! Selling government (taxpayer) assets can reduce the deficit in the short term, but it won’t have significant long-term benefits. These sales result in little more than a misleading reduction in the budget deficit a government reports. It’s misleading in the sense that it is a one-time, short-term windfall. It is not the result of government getting its spending under control. So, while the sale of public assets can reduce short-term government deficits, it has no significant impact on the remaining long-term government debt.

Provincial governments own a range of assets. Some of them are intended to generate a public service, while others are intended to create revenue for government (like the sale of alcohol). So, when governments decide to sell an asset, they are either surrendering control over a public service or losing a revenue stream.

When government’s sell assets, they often fail to get a fair price. This is frequently caused by government’s failure to conduct an accurate cost-benefit analysis. In situations where privatization results in the loss of a revenue source, the sale of that asset is unlikely to have a significant positive impact on that government’s level of debt.

In fact, privatization can often lead to more government spending to cover hidden costs associated with privatization such as administration of the contract and monitoring the quality of services delivered.

MYTH #14: Reducing debt is an urgent government priority.

BUSTED! Cutting services and selling assets to reduce government debt ignores the fact that governments have substantial assets to use as collateral when they borrow money. As long as a government still have assets that could be sold off to repay their debt, there is little cause for concern. When governments talk about privatization, they often argue that paying off debt is their top priority. They rarely talk about the benefits of not making debt repayment a priority.

Modern monetary theory suggests government decision-making should not be entirely guided by debt. Governments operate very differently than a household. They don’t have the same need to keep their spending under control, and they don’t face the same consequences if they don’t. In fact, high government spending means households need to spend less to use public services. Cutting government spending means households pay more toward the cost of public services. Governments can use their purchasing power to continue funding public services that increase the value of public assets and support the province’s residents. Increasing the value of public assets is a valid alternative to paying off debt.

SOURCES:

Dowson, N. (2018, May 21). Efficiency Myth. New Internationalist. https://newint.org/features/2018/05/01/the-private-sector-efficiency-myth

In the Public Interest. Privatization myths debunked. http://pausebuttonforddsfiveyearplan.org/docs/2-Bibliography/2016,%201-1-Privatization%20Myths%20Debunked,%20ITPI.pdf